Sovereign Gold Bond Scheme 2021-22 Series VII

With the Reserve Bank of India consultation, the GOI has decided to issue Sovereign Gold Bonds.

Details of Sovereign Gold Bond 2021-22 Series VII

Opens on: Monday 25-Oct-2021

Closes on: Friday 29-Oct-2021

Issuance Date: Tuesday 02-Nov-2021

Issue price: Rs. 4,761/- per gram

Discount: Rs. 50 per gram (if you apply online)

Net price after discount: Rs 4,711/- per gram

From October 2021 to March 2022, the Sovereign Gold Bonds will be issued in Four Tranches :

| S.No. | Tranche | Date of Subscription |

|---|---|---|

| 1 | 2021-22 Series VII | Oct 25-29, 2021 |

| 2 | 2021-22 Series VIII | Nov 29-Dec 03, 2021 |

| 3 | 2021-22 Series IX | Jan 10-14, 2022 |

| 4 | 2021-22 Series X | Feb 28-Mar 04, 2022 |

Read our previous blogs to learn more about Sovereign Gold Bonds:

Sovereign Gold Bond 2021-22 Series I

Sovereign Gold Bond 2021-22 Series II

Have a Look at some of the points:

Tenor:

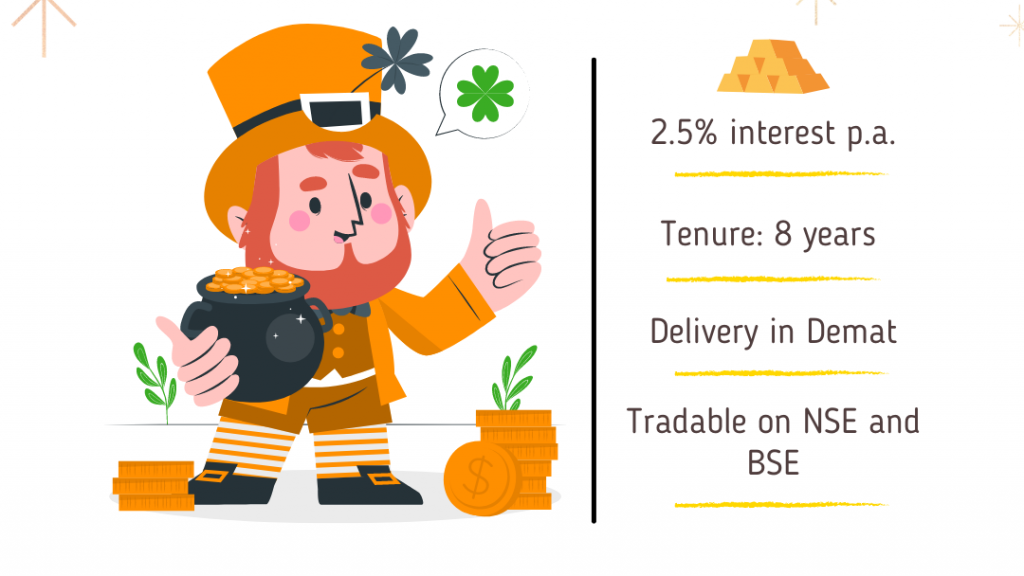

The bond’s tenor is eight years.

Premature redemption:

From the 5th year, thirty days before the coupon payment date, investors can approach the concerned bank/Post Office/agent. If the investor approaches the concerned post office/ bank at least one day before the coupon payment date, only then the request of the issuer will be entertained.

However, as the bond will be listed in NSE and BSE, bond holders holding bonds in demat account can exit at anytime by selling their holding in the exchange.

Nomination facility:

Yes, nomination facility is available on Sovereign Gold Bonds as per the Government Securities Act, 2006, and the Government Securities Regulations, 2007. A nomination form is available along with the Application Form. But this is required only if you hold physical bonds. If the bonds are held in a demat account, a nominee in the demat account will be considered as a nominee for the bonds too.

A non-resident Indian may get the security transferred in his name on account of his being a nominee of a deceased investor provided that:

- the Non-Resident investor shall need to hold the security till early redemption or till maturity; and

- the interest and maturity proceeds of the investment shall not be repatriable.

Loan against Bonds:

The loan-to-value (LTV) ratio is set equal to the ordinary gold loan mandated by the Reserve Bank from time to time.

Transfer:

The bond can be transferable/ gifted to a friend/ relative/ anybody who fulfils the eligibility criteria. The Bonds shall be transferable before maturity by execution of Form ‘F’, which is available with the issuing agents. Bonds held in demat form can be transferred in exactly same way as shares held in demat account can be transferred.

Eligible Investor:

As defined under the FEMA (Foreign Exchange Management Act), 1999, A person resident in India can invest in SGB. Eligible investors include individuals, trusts, HUFs, charitable institutions and universities. With subsequent changes in the residential status of individual investors from resident to non-resident, they may continue to hold SGB till early maturity/redemption.

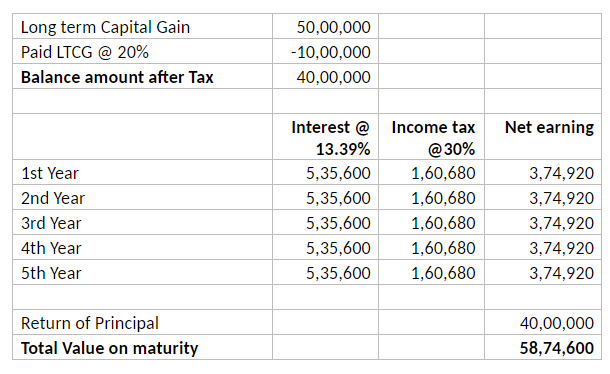

So, why invest in Sovereign Gold Bonds?

1. Safest way to buy and store gold

2. Earn 2.5% interest per annum payable semi-annually

3. Appreciation opportunity plus assured interest

4. Tradable on the stock exchanges

5. No TDS applicable

6. Available in both Demat and Paper Form

7. Indexation benefit for transferring after 3yrs but before maturity

8. No Capital Gain on redemption at the time of maturity.

Happy Investing.

Regards