The Interest Rate of 5% in Capital Gain Bonds is Equivalent to 13.39% Invested Elsewhere

Capital Gain Bond (54EC)

Whenever anyone sells an asset (Land or Building or both) and has capital gain arising from it, he has to pay capital gain tax to the government. A short-term capital gains tax of 30 per cent is applicable for those in the highest tax bracket on selling a property within two years of purchase. A long-term capital gain tax of 20 per cent becomes applicable if sold after two years of purchase.

One way to save taxes on long-term capital gains arising from the sale of immovable property is by investing the profit in specified tax-saving bonds under section 54EC of the Income Tax Act.

But as Capital Gain Bonds bear an interest rate of only 5%, is it wise to invest capital gains in these bonds and block your capital for 5 years? Or is it better to pay the capital gain tax and invest the balance sum in an alternate asset that gives better returns?

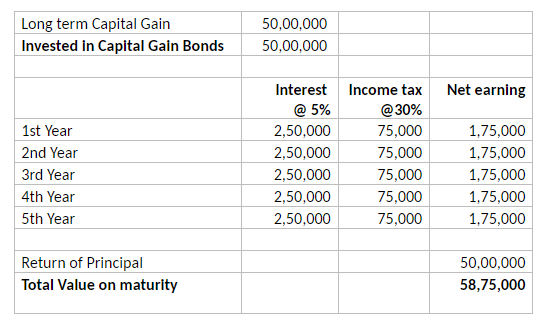

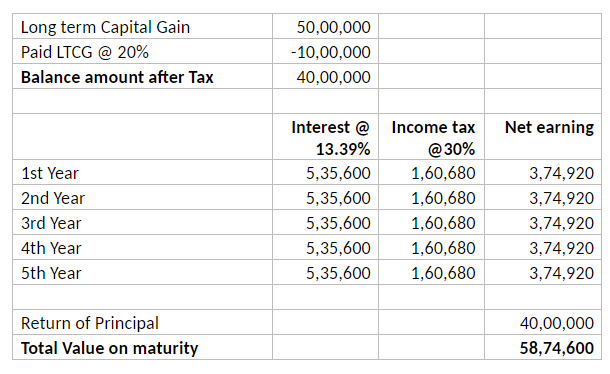

Have a look at the comparative analysis for a person in the income tax bracket of 30%:

So effectively, the total money you would have at the end of 5 years would be the same if you deposit your Capital gains in Capital Gain Bonds @ 5% or if you pay capital gain tax now and invest the balance amount @ 13.39%. These calculations do not consider the income generated on reinvestment of interest pay-out received during these five years and surcharge/cess payable on Taxes.

What are Capital Gain Bonds (54EC Bonds)

As per the Income Tax Act, 1961, any long term capital gains from the transfer or sale of real estate would be taxable. Such gains are exempted from capital gain tax if invested in capital gain bonds specified in section 54EC of the income tax act, subject to the upper limit of Rs.50 Lakh in a Financial Year (FY).

Following are the main feature for 54EC Bonds:

Rate of Interest: 5.00% p.a. payable annually

Min Investment: 1 Bond (Rs 10,000)

Max Investment: 500 Bonds (Rs 50,00,000) in a Financial Year

Taxation: Interest is taxable, but no TDS is deducted

Redemption: Automatic Redemption after 5 Years

Mode of Holding: Physical or Demat

Who issues Capital Gain Bonds?

The eligible bonds under Section 54EC are issued by:

REC (Rural Electrification Corporation Ltd),

PFC (Power Finance Corporation Ltd),

NHAI (National Highways Authority of India) and

IRFC (Indian Railways Finance Corporation Limited).

Why invest in 54 EC bonds?

The profit that arises on the sale of Capital Asset (land or building or both), known as long-term capital gains, attract Capital Gains Tax. However, long-term capital gain tax can be saved by investing the profit in the capital gain bonds specified under section 54 EC.

What is the maturity period of Capital Gain Bonds (54EC)?

Capital Gain Bonds (54EC) are redeemable after 5 Years.

Is there a lock-in period for Capital Gain Bonds (54EC)?

Yes, there is a Lock-in period of 5 Years in 54EC bonds (effective from April 2018), and they are non-transferable. However, in case of the death of the bondholder/beneficiary, the transmission of bonds to the legal heirs is allowed.

How do I buy Capital Gain Bonds (54EC)?

Our team at TR Capital can assist you in buying Capital Gain Bonds issued by all four issuers. Though it is advisable to buy these bonds in demat form, we can assist you in buying these bonds in both demat form or physical form as per your choice.

What are the charges for buying Capital Gain Bonds (54EC)?

We do not charge anything from the investors for applying Capital Gain Bonds (54EC).

Are Capital Gain Bonds (54EC) Safe?

The government backs 54EC bonds; hence the risk factor associated with buying 54EC bonds is mitigated. The 54 EC bonds are AAA rated by ICRA and CRISIL.

What is the Time limit to invest in Capital Gain Bonds (54EC) after the sale of Capital Asset (Land or Building or both)?

The profit from the sale of an asset should be invested in Capital Gain Bonds within 6 months from the date of sale.

When is the interest paid for Capital Gain Bonds (54EC)?

Interest is paid every year on the following dates:

PFC- 54EC Bonds: on 31st July

REC- 54EC Bonds: on 30th June

IRFC- 54EC Bonds: on 15th October

NHAI- 54EC Bonds on 31st March

Is interest received on 54EC Bonds tax-free?

Interest earned on bonds is taxable. However, TDS is not deducted at the time of payment of interest.

What is the minimum investment amount in Capital Gain Bonds (54EC)?

The minimum investment in 54EC bonds is 1 bond of Rs. 10,000.

Is there any maximum limit of investment in Capital Gain Bonds (54EC)?

The maximum investment allowed in 54EC bonds is 500 bonds (or Rs 50 lakhs) in a financial year.

What is the procedure in the eventuality of the death of an investor?

Bonds are not transferable; however, they can be transmitted to the nominee in the event of the bondholder’s death. The interest accrued from the bond after the date of transmission shall be taxable in the hands of the nominee. The nominee shall hold the bonds till maturity.

Usha Verma

Equity Advisor, TR Capital

B.Com., CA IPCC (Intermediate)